(A Green Circle Capital White Paper)

by Stu Strumwasser, Managing Director, Green Circle Capital

November 2020 ©

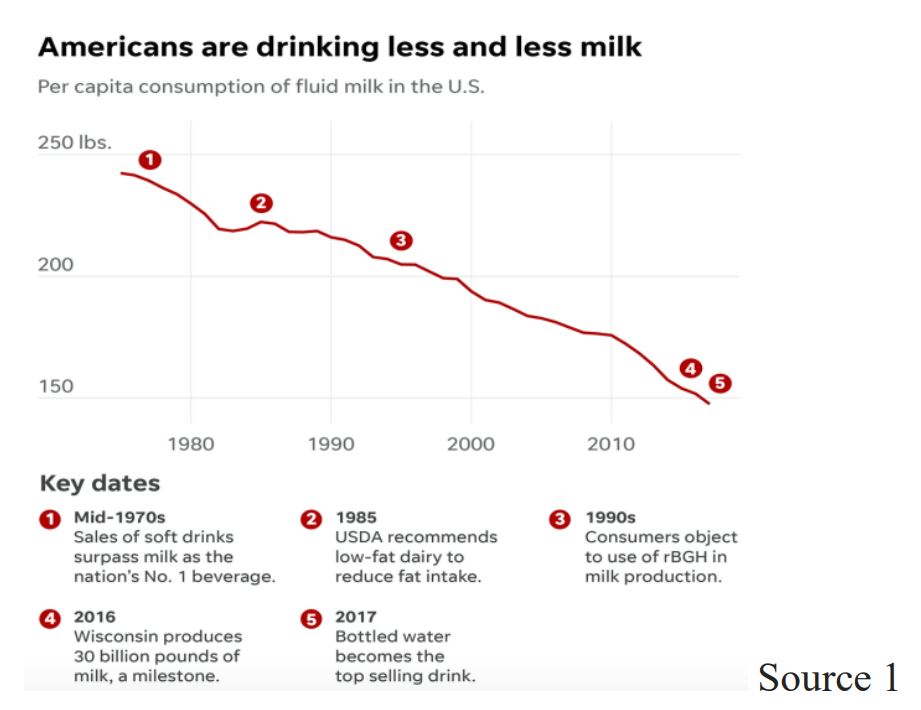

The Fall of Dairy Milk

Many American consumers are aware that consumption of dairy milk has declined. What may surprise you is the degree of that decline. According to the USDA, consumption of milk in the United States declined over 27% between the 1970s and 2012 (1) on a per capita basis (from approximately 278.8 pounds/person/year to only 198.8). That rate of contraction has only increased in recent years as healthier and more sustainable products like nut-based milks have entered the market. Per capita consumption of dairy milk in the US is now around 150 pounds.) Statista, citing Nielsen data, have even purported that consumption had already dropped to 149 pounds of fluid dairy per capita per annum by 2017. (2) In other words, consumption of fluid dairy milk may be down nearly 50% in the United States since the 1970s, and that trend does not seem to be slowing.

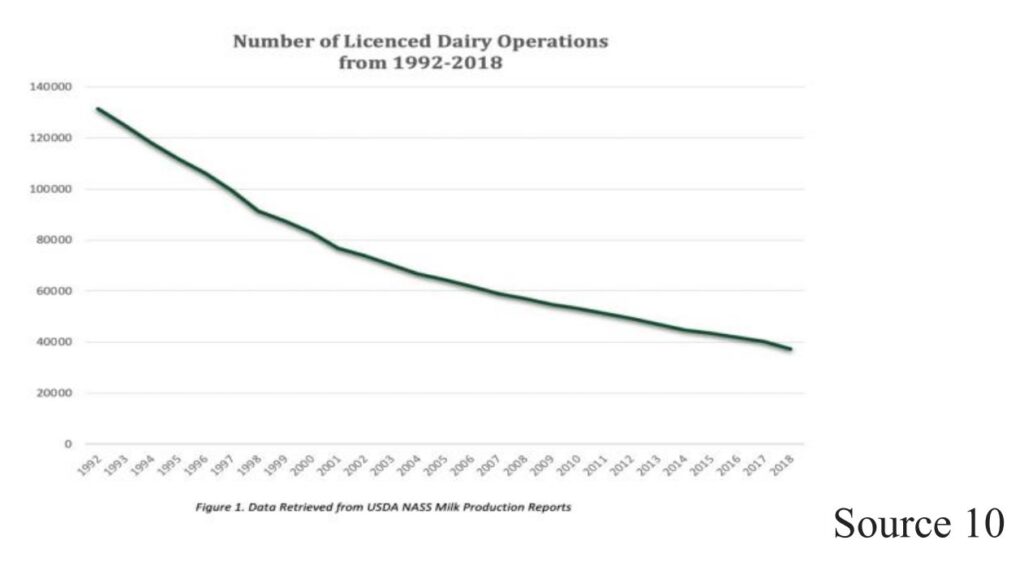

Nothing has highlighted this decline better than the recent filings for Chapter 11 bankruptcy of Dean Foods and Borden Dairy—at one point the number one and two purveyors of dairy milk in the US—which were once considered top tier, blue chip companies. Eric Beringause, CEO of Dean Foods, stated shortly after the bankruptcy announcement, “Despite our best efforts to make our business more agile and cost-efficient, we continue to be impacted by a challenging operating environment marked by continuing declines in consumer milk consumption.” (3) Some experts believe that if these trends continue, we may not have a dairy industry in as little as 10 years. (4,5) In 2018 alone, Dairy Farmers of America, which represents about 30% of total U.S. milk production, reported a 7.5% decrease in sales. (3) This has had a catastrophic impact on dairy farmers: from 1992 to 2018, the number of U.S. dairy farms has rapidly declined with over 94,000 dairies going out of business, that is nearly ten per day over that time span. (10) The number of licensed dairy herds fell in each year between 2002 and 2017, at an average annual rate of 4.0 percent. The number of licensed herds then fell by 2,731 farms in 2018 alone, or 6.8 percent of the 2017 total, and then fell another 8.8 percent in 2019 as the total contracted by 3,281 farms. (31)

According to FB.org, “since the end of 2014, dairy farmers have struggled with low prices resulting from large supplies outweighing demand in the U.S. and around the world. While we have historically seen year-over-year declines in the number of dairy operations, the data from 2019 shows this challenging price environment proved to be too much for many operations throughout the country.”(18) Surplus of supply stems from technological advancement in the space and consolidation in order to combat unsustainable margins, leading to further imbalance. (10)

The fall of the dairy industry causes several macroeconomic consequences. Along with bankruptcies of core blue-chip players comes destruction of value for investors, defaults to lenders, and job losses. Traditional dairy has historically contributed 1% to total U.S. GDP, generating an economic stimulus of over $600 million per year. (10) Three million jobs and nearly $160 billion in yearly wages appear to be at stake. (10) There will be a nationwide pivot needed if this trajectory continues wherein millions of workers may be compelled to find work elsewhere. Fortunately, the rapid growth of dairy alternatives gives the opportunity for a lateral transfer of skills and experience from traditional dairy.

What About Creamers?

In stark contrast to the decline in consumption of fluid dairy milk, creamers of all varieties— including those sourced from cows—are growing. As global coffee consumption continues to enjoy strong growth, creamers have also continued to grow steadily. Most estimates put the market at between five and six billion dollars globally. 360 Research Reports states: “The global Coffee Creamer market is valued at 5715.6 million US$ [$5.7 billion] in 2020 and is expected to reach 7143.2 million US$ by the end of 2026, growing at a CAGR of 3.2% during 2021- 2026.”(34) Other sources, such as Technavio, project growth of more like 5% CAGR during that period.

The non-dairy segment of the creamer category, unsurprisingly, is growing faster. According to Allied Market Research, “The global non-dairy creamer industry generated $1.73 billion in 2019, and is expected to garner $2.38 billion by 2027, witnessing a CAGR of 7.3% from 2021 to 2027.”(35)

Notably, the sub-segment enjoying the fastest growth is those made with plant-based ingredients. An article in Foxbusiness.com quotes the Wall Street Journal by stating that, “Sales of plantbased coffee creamers rose 30 percent last year [2019] to 8 percent of the creamer market, according to Nielsen data.”(36) According to Expertmarketresearch.com, “In 2015, an estimated 65% of the coffee drinkers, globally, added creamers to their drink to enhance its sweetness/ creaminess and flavours. A significant proportion of the creamers consumed was comprised of plant-based ingredients like soy.”(37) They acknowledge both the large size of this segment and also that growth is being driven by plant-based products, and add: “The global non-dairy creamer market is being driven by a growing demand for dairy alternatives… Between 2017 to 2020, plant-based dairy is expected to witness a robust growth across multiple categories, with plantbased coffee creamers projected to grow by 20-30%.”(37) To quantify the size of that segment they say that, “In North America, a leading non-dairy creamer market, plant-based creamers accounted for nearly 5% of the regional creamer industry, with the market share of the segment expected to grow further in the coming years.” That would put the non-dairy creamer market in North America at about $110M in 2018 (the year of that article).

The Rise Of Alternative Dairy Milk Segments

In 2020, there are now several alternatives to cow milk—including but not limited to those made with ingredients from soy, almonds, cashews, macadamias, oats, peas and rice. What they all have in common is growing consumer acceptance and demand, and together, they are changing the dairy industry, pointing toward a collapse of traditional milk producers, and possibly all dairy products. According to a study by Research & Markets, the global plant-based milk market is expected to reach US$21.52 billion in 2024, growing at a CAGR of 10.18%, for the duration spanning 2020-2024 (33) , putting the market value at about $13.4 billion in 2019.

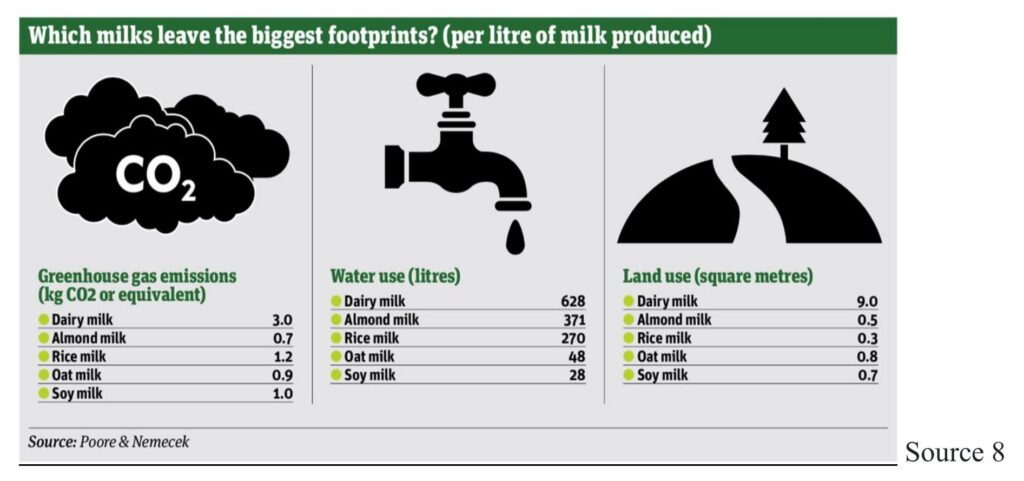

Soy, for example, has been used as a dairy alternative for decades. The global soy milk market size is expected to reach USD 11.08 billion by 2025, according to a new report by Grand View Research, Inc., expanding at a CAGR of 6.1% over the forecast period. That would put the market size in 2019 at about $8.25 billion (6). It is notable that presently 97% of soy is processed into animal feed. (7) Therefore, the resources needed for growing soymilk production (including land) are already established and being used for dairy production. Shifting those resources to the production of additional soy milk would not require further cultivation and could make the process of creating soy milk much more efficient. Production of soy milk requires 90% less land, 95% less water, and generates just 33% of greenhouse gases compared to dairy milk produced from cows. (8)

The U.S. soy milk market is small compared to that of other countries, such as those in Asia. Eight of the top twelve soy drinking countries are in Asia with Hong Kong topping them all (on a per capita basis), consuming nearly 17 liters per year per capita. (9) U.S. consumption has been contracting on the other hand, mostly due to the stigma around GMO soy (not shared by Asian consumers) and soy more broadly in terms of health, as well as the growth of substitute options like nut and oat milk. According to Mintel, U.S. consumption of both soy food and beverages is only about 1.5 liters per year per capita. (9)

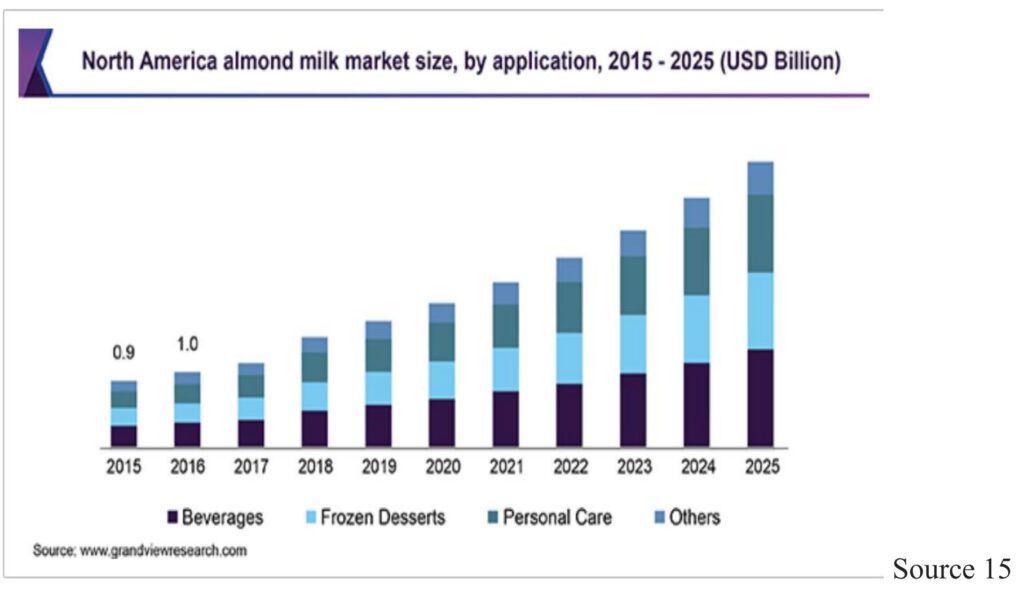

The vegan milk segment that fueled the most growth to the overall industry in recent years is almond milk. Almonds are the base of 65% of non-dairy milk (as measured by dollar sales) with a market value of over $5 billion as of 2018 (11,12). Almond milk was the first main-streamed dairy alternative in the U.S., rising to prominence in the early 2000s. However, today it is one of many bases for non-dairy alternative products in the market. The biggest threat to almond milk producers (other than a quickly expanding array of competitors whose products are made from different ingredients) is that over 80% of almonds are grown in California, where droughts and climate change put entire harvests (and supply) at risk every year. (15)

Rice milk is a $1 billion market and expected to be worth $2.6 billion by 2024. (13) Rice milk is very popular in Asia and is the third biggest non-dairy milk market behind soy and almond due to its hypoallergenic properties and health characteristics such as low cholesterol and saturated fats. (14) Conversely, rice milk’s most significant weakness is its low nutritional value compared to other dairy alternatives: it is high in carbohydrates and low in protein and calcium. Rice milk’s carbohydrate content can be three times greater than that of almond or soy milk. (26)

Most recently, oat milk has been the hottest alternative to dairy milk. According to Global Market Insights, the global oat milk market size exceeded $250 million globally in 2019 and is estimated to grow at over 10.2% CAGR between 2020 and 2026, due to rising dairy milk allergies along with increasing awareness on the potential benefits of oat milk. (15) Oatly is the biggest pure play in the market, leading the category to an estimated $500 million value by 2026. (16) In terms of sustainability, “oat milk has around 70% less impact on the climate compared to cow’s milk and consumes just under 40% of its energy in production. Land use is almost 80% lower than traditional dairy.” (8) Oat milk is in high demand because of its high protein and calcium content as well, and works well as an ingredient in baking versus other vegan dairy options. (16) For consumers, the negatives of oat milk are its high carbohydrate content and calorie count compared to other non-dairy milks, which could prevent many healthconscious consumers from converting. (23)

Pea milk is now a unique and popular non-dairy milk alternative in that it is mostly used as an ingredient in non-dairy products. There is only one pea-milk producer in the U.S. with meaningful traction, Ripple Foods. (17) Sproud, a new entrant from Europe, also appears to be growing. Pea milk has a very low carbon and water footprint due to its miniscule need for fertilization and irrigation. It requires 96% less water than almond milk requires, 99% less than dairy milk, and 76% less than soy milk. (17) It is also a great source for protein, Vitamin D, iron, and DHA omega-3s. (17) However, the biggest headwinds for pea milk are consumer education and adoption, and cost. Peas are seen as by consumers as an unusual base for milk. Despite that, the main component extracted from peas is the protein, which is flavorless. This is a major reason for its use as an ingredient in other vegan products like shakes, yogurt and creamers. However, pea milk on average is priced 30% higher than organic dairy milk, which is also limiting its consumption among more cost-conscious consumers. (17)

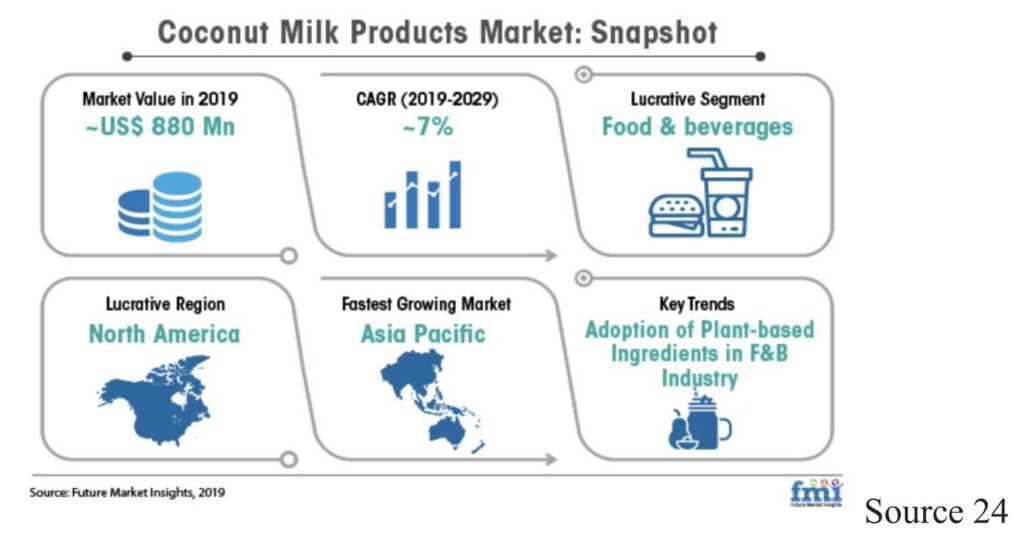

Coconut milk is a relatively mature market yet smaller than those of almond and soy milk, valued at just $880 million and projected to have a CAGR of about 8% through 2022 (24, 25). Coconut milk is ideal for the allergy-prone types who don’t consume dairy and are allergic to nuts and soy.

Hemp milk is a new and perhaps most speculative segment within the plant-based milk alternatives. According to a report by Arizton, the hemp milk market is projected to be valued at over $450 million by 2024, growing at a rapid CAGR of approximately 16% between 2018 and 2024. (27) This puts the value of the hemp milk market at about $186 million in 2018. According to Good Hemp milk, a player in the space, hemp grows naturally without the need for herbicides or pesticides, and requires little water to grow. (28) Also, the plant can breathe up to four times more CO2 than some trees and plants. (28) Along with low environmental impact, hemp milk also has great health benefits like high protein and fat content, and less carbohydrates compared to dairy and other alternatives. (29) However, until the market develops, prices will remain high for the average consumer.

Notably, the fastest-growing segment within the overall plant-based milk category contains products made with base ingredients other than the ones mentioned above. According to a survey of SPINS data (for both MULO and Natural Channels) conducted on February 23, 2020, macadamia milk and those made with other new and different ingredients are actually growing faster than all other plant-based milk segments (such as soy or almond).

As a whole industry, dairy alternatives have several tailwinds supporting their success and continued rapid growth. According to a report by Arizton, “approximately 49% of the population are cutting down on meat consumption due to health reasons. Some of the major reasons for adoption of vegan diets include weight management, animal welfare and environmental protection,” which are all continuing to trend upward. (30) The number of vegans in the U.S. is small but rising every year, and globally, lactose intolerance is leading more and more people to seek dairy alternatives. Also, as more bankruptcies occur among the large dairy companies, there will be more alternatives to take the place of a broken traditional dairy market and its supply chain.

Non-Dairy Cheese Takes Off

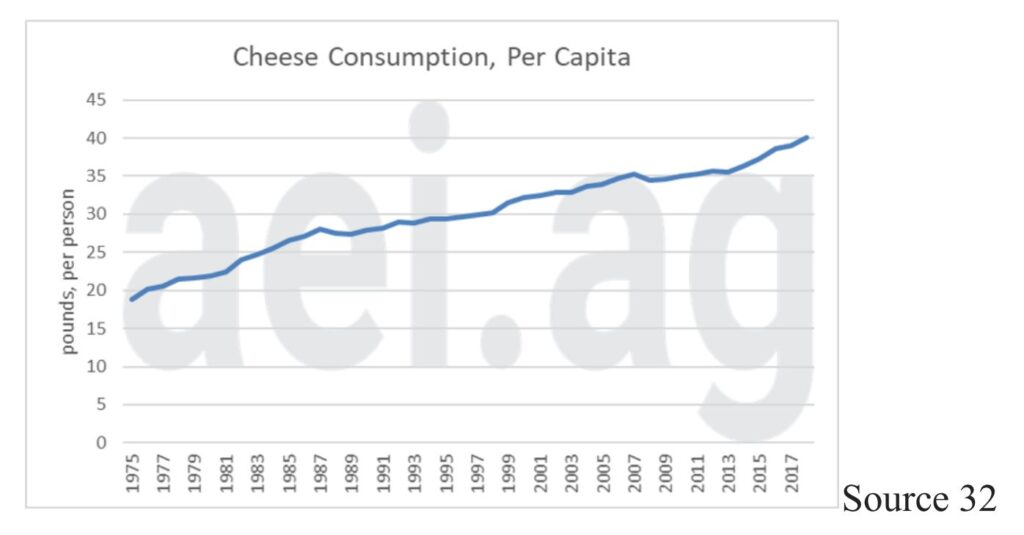

The USDA study referenced at the beginning of this paper also analyzes cheese. Per capita cheese consumption has shot up from about 16 pounds per year in 1970 to over 36 pounds in 2012. (1) In recent years that trend continued with cheese consumption going to 40 pounds per capita in 2018. (32) Americans are consuming more cheese than ever.

While traditional dairy cheese continues to grow (in contrast to the declining consumption of fluid milk) plant-based cheese consumption is growing far more rapidly. According to a global plant-based cheese report done by researchandmarkets.com, the plant-based cheese market is projected to grow at a CAGR of over 15% during the period 2018-2024. (19) The non-dairy cheese market is projected to grow at a CAGR of 8.1% between 2020 and 2025, according to a report by mordorintelligence.com. (20) In another report by Market Scenario, “the global Non-Dairy Cheese Market is projected to grow with a significant growth rate of 7.83% from 2019 to 2024 and reach a market value of USD 2.56 billion by the end of 2024,” which would put the value of the sector at about $1.87 billion. (21) Whether the growth rate turns out to be 8%, 15%, or somewhere in between, all projections are very positive.

The millennial population, deeply concerned with animal rights, the environment, and their own health, is driving the demand for alternative cheese. (19) In addition, globally, lactose intolerance is widespread, and in some Asian countries lactose intolerance rates are as high as 70% or even 90%, which is influencing the move to alternative dairy abroad. (20) The plant-based cheese segment accounts for approximately 6% of the global non-dairy market; North America accounted for the largest geographical market, followed by Europe. APAC is expected to witness the fastest growth during the forecast period due to its logical market for such products (based on lactose intolerance) combined with its broader adoption of such innovative products which is occurring a little later than it did in Europe and the US. (19)

When it comes to the styles of alternative cheeses available, mozzarella cheese comprised approximately 35% of the global plant-based cheese market in 2018. (19) Furthermore, North America accounts for the largest market for vegan parmesan cheese, and the trending demand toward cleaner label including the terms “organic,” “gluten-free,” “soy-free,” “non-GMO,” and others is driving the cheddar cheese segment. (19) Vegan cheese shreds are popular plant-based alternatives. (19) This format is wide availability and more varieties and flavors are being developed, which is expected to support the growth of this segment over the next 5 years. (19) According to the report, “The global plant-based cheese market is fragmented and vendors are competing based on product quality, innovations, and competitive pricing. Thus, consumer choices and preferences differ across regions and keep changing in response to geographical, demographic, and social trends, and economic circumstances. Due to the highly competitive and dynamic environment, future growth within this market environment mainly depends on the ability to anticipate, gauge, and adapt to the constantly changing trends and successfully introduce new or improved products on time.” (19)

Historically, vegan cheese has seen great growth, especially over the last few years. The growth and success of plant-based milk has paved the way for the acceptance of vegan cheese, according to Caroline Bushnell, the senior marketing manager for the Good Food Institute. (21) According to Nielsen data, “sales of plant-based cheese grew 41% through August of last year, while sales of regular dairy cheese were flat.” (21) “Milk and cheese” production is turning to plants, and giving the cows a break. That trend appears to be poised to continue for years to come.

- Bentley, Jeanine. “Trends in U.S. Per Capita Consumption of Dairy Products, 1970- 2012.” USDA ERS – Trends in U.S. Per Capita Consumption of Dairy Products, 1970- 2012, 14 June 2014, www.ers.usda.gov/amber-waves/2014/june/trends-in-us-per-capitaconsumption-of-dairy-products-1970-2012?mbid=synd_yahoohealth

- McCarthy, Niall, and Felix Richter. “Infographic: Milk’s Massive American Decline.” Statista Infographics, 13 May 2019, www.statista.com/chart/2387/american-milkconsumption-has-plummeted

- Bomey, Nathan. “Dean Foods Files for Chapter 11 Bankruptcy, Lines up Sale.” USA Today, Gannett Satellite Information Network, 12 Nov. 2019, www.usatoday.com/story/money/2019/11/12/dean-foods-chapter-11-bankruptcyfiling/2574006001/

- Angeles, Jill EttingerContributor | Los, et al. “Dairy Milk Sales Dropped $1.1 Billion Last Year.” LIVEKINDLY, 12 June 2019, www.livekindly.co/dairy-industry-disappeardecade/

- “Food and Agriculture Report.” RethinkX, www.rethinkx.com/food-and-agriculture

- “Soy Milk Market Size Worth $11.08 Billion By 2025: CAGR: 6.1%.” Market Research Reports & Consulting, Apr. 2019, www.grandviewresearch.com/press-release/globalsoy-milk-market

- “Zur Ökobilanz Von Pflanzenmilch • Albert Schweitzer Stiftung.” Albert Schweitzer Stiftung Für Unsere Mitwelt, 9 Mar. 2018, albert-schweitzerstiftung.de/aktuell/oekobilanz-pflanzenmilch

- Brown, Rob. “How Environmentally Friendly Is Vegan Milk?” The Grocer, 25 Sept. 2019, www.thegrocer.co.uk/plant-based/how-environmentally-friendly-is-veganmilk/597897.article

- Starling, Shane. “Asia Continues to Dominate Soy Milk Consumption.” Foodnavigator.com, William Reed Business Media Ltd., 20 Apr. 2011, www.foodnavigator.com/Article/2011/04/20/Asia-continues-to-dominate-soy-milkconsumption

- Kaika, Allison. “It’s Time to Reform the U.S. Dairy Industry.” National Farmers Union, 18 June 2019, nfu.org/2019/06/18/its-time-to-reform-the-u-s-dairy-industry

- Chiorando, Maria. “US Oat Milk Sales Surge By 686% As Vegan Boom Continues.” Plant Based News, 1 Oct. 2020, plantbasednews.org/lifestyle/us-oat-milk-sales-surge686/

- “Almond Milk Market Size, Share: Global Industry Report, 2019-2025.” Almond Milk Market Size, Share | Global Industry Report, 2019-2025, www.grandviewresearch.com/industry-analysis/almond-milk-market

- “$2.6 Billion Rice Milk Market – Global Forecasts to 2024 – ResearchAndMarkets.com.” Business Wire, 3 Sept. 2019, www.businesswire.com/news/home/20190903005373/en/2.6-Billion-Rice-Milk-Market– -Global

- “Pros and Cons of Rice Milk / Nutrition / Healthy Eating.” Fit Day, www.fitday.com/fitness-articles/nutrition/healthy-eating/pros-and-cons-of-rice-milk.html

- Ahuja, Kunal, and Kritika Mamtani. “Oat Milk Market Share Statistics 2020-2026: Industry Report.” Global Market Insights, Inc., Mar. 2020, www.gminsights.com/industry-analysis/oat-milk-market

- Global Market Insights, Inc. “Oat Milk Market Revenue to Hit $490 Million by 2026, Says Global Market Insights, Inc.” GlobeNewswire News Room, “GlobeNewswire”, 2 Apr. 2020, www.globenewswire.com/news-release/2020/04/02/2010557/0/en/Oat-MilkMarket-revenue-to-hit-490-million-by-2026-Says-Global-Market-Insights-Inc.html

- “Pea Milk Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 – 2025.” Transparency Market Research, www.transparencymarketresearch.com/pea-milk-market.html

- “Largest Decline in U.S. Dairy Farms in 15-Plus Years in 2019.” American Farm Bureau Federation – The Voice of Agriculture, 28 Feb. 2020, www.fb.org/market-intel/largestdecline-in-u.s.-dairy-farms-in15-plus-years-in-2019

- “Global Plant-Based Cheese Market Report 2019-2024 – Increasing Vegan Population / High Prevalence of Lactose Intolerant Population / Growing Health Conscious Population – ResearchAndMarkets.com.” Business Wire, 3 Dec. 2019, www.businesswire.com/news/home/20191203005765/en/Global-Plant-based-CheeseMarket-Report-2019-2024-

- “Global Non-Dairy Cheese Market: Growth: Trends: Forecasts.” Global Non-Dairy Cheese Market | Growth | Trends | Forecasts, www.mordorintelligence.com/industryreports/non-dairy-cheese-market

- “Non-Dairy Cheese Market Trends, Size, Share and Global Analysis, 2024: MRFR.” Non-Dairy Cheese Market Trends, Size, Share and Global Analysis, 2024 | MRFR, Sept. 2020, www.marketresearchfuture.com/reports/non-dairy-cheese-market-3114

- Marx, Rebecca Flint. “Not Milking It: How Vegan Cheese Finally Caught up with Modern Appetites.” The Guardian, Guardian News and Media, 16 May 2019, www.theguardian.com/food/2019/may/15/vegan-cheese-change-diets

- Family Health Team. “Is Oat Milk Good for You? A Dietitian Explains This Trendy Dairy Alternative.” Health Essentials from Cleveland Clinic, Health Essentials from Cleveland Clinic, 2 Oct. 2020, health.clevelandclinic.org/is-oat-milk-good-for-you-adietitian-explains-this-trendy-dairy-alternative/

- Valley Cottage, United States – October 15. “Coconut Milk Products Market Is Anticipated to Grow at a CAGR of ~7% during the Forecast Period of 2019 to 2029 ” MarketersMEDIA – Press Release Distribution Services – News Release Distribution Services.” MarketersMEDIA Press Release Distribution Services News Release Distribution Services, marketersmedia.com/coconut-milk-products-market-is-anticipatedto-grow-at-a-cagr-of-7-during-the-forecast-period-of-2019-to-2029/88928179

- “Global Packaged Coconut Milk Market 2018-2022: New Product Launches to Promote Growth: Technavio.” Global Packaged Coconut Milk Market 2018-2022| New Product Launches to Promote Growth| Technavio | Business Wire, 25 June 2018, www.businesswire.com/news/home/20180625006125/en/Global-Packaged-CoconutMilk-Market-2018-2022-New

- “Global Rice Milk Market: Growth: Trends: Forecasts.” Global Rice Milk Market | Growth | Trends | Forecasts, www.mordorintelligence.com/industry-reports/rice-milkmarket

- Arizton Advisory & Intelligence. “Global Hemp Milk Market: Industry Analysis, Market Size, Share, Trends, Growth, and Forecast 2019-2024: Arizton.” Arizton Advisory & Intelligence, www.arizton.com/market-reports/hemp-milk-market

- “Hemp Milk Vs Other Milks: A Comparison.” Good Hemp, 24 July 2019, www.goodhemp.com/hemp-hub/good-hemp-drink-vs-other-drinks/

- Streit, Lizzie. “Hemp Milk: Nutrition, Benefits and How to Make It.” Healthline, 7 Nov. 2018, www.healthline.com/nutrition/hemp-milk

- “MarketResearch.com.” Market Research, Arizton Advisory and Intelligence, 19 Mar. 2019, www.marketresearch.com/Arizton-v4150/Non-Dairy-Milk-Global-Outlook12287735/

- MacDonald, James, et al. “Consolidation in US Dairy Farming.” USDA Economic Reserve Service, July 2020, www.ers.usda.gov/webdocs/publications/98901/err274.pdf?v=4718

- Widmar, David. “U.S. Dairy Consumption Trends in 9 Charts.” Agricultural Economic Insights, 24 Feb. 2020, aei.ag/2020/02/23/u-s-dairy-consumption-trends-in-9-charts/

- Markets, Research and. “Worldwide Plant Based Milk Market to 2024 – In-Depth Analysis of Growth Drivers, Market Trends and Challenges.” PR Newswire: News Distribution, Targeting and Monitoring, 6 Mar. 2020, www.prnewswire.com/newsreleases/worldwide-plant-based-milk-market-to-2024—in-depth-analysis-of-growthdrivers-market-trends-and-challenges-301018888.html

- 360 Research Reports, Global Coffee Creamer Market research Report, 2020, January 2, 2020, https://www.360researchreports.com/global-coffee-creamer-market-15046624

- Allied Market Research, via, PR Newswire, Non-Dairy Creamer Market to reach $2.38 Bn, Globally, by 2027 at 7.3% CAGR, July 21,2020. https://www.prnewswire.com/newsreleases/non-dairy-creamer-market-to-reach-2-38-bn-globally-by-2027-at-7-3-cagr-amr301096811.html#:~:text=All%20Products- ,Non%2DDairy%20Creamer%20Market%20to%20reach%20%242.38%20Bn%2C%20Gl obally%2C,2027%20at%207.3%25%20CAGR%3A%20AMR

- Foxbusiness.com, Amazon, cafes driving plant-based coffee creamer sales, https://www.foxbusiness.com/markets/amazon-plant-based-coffee-creamer

- Expertmarketresearch.com, Global Non-Dairy Creamer Market Key Insights. https://www.expertmarketresearch.com/reports/non-dairy-creamer-market

For further information, please contact the authors: