Navigating the Post-COVID-19 Restaurant Industry for Investors and Operators

-Mike Vieten, CFA, Managing Director – Restaurants, July 2020

(A Green Circle White Paper)

As seen in QSRMagazine.com on 8/4/2020.

Introduction:

We are living in a time of unprecedented change in the economy and in the world at large, and nowhere is that more evident than in the restaurant industry. At Green Circle Capital, our professionals know, from decades of experience, that out of every crisis also comes innovation and opportunity.

Over the past six years, Green Circle has advised numerous clients across the food and beverage (F&B) ecosystem, assisting forward-looking and better-for-you brands in raising needed growth capital or in achieving an exit. In the wake of COVID-19, we launched our Restaurants Practice as an extension of our F&B network and expertise, to serve the adjacent restaurant industry.

We seek to partner with restaurant brands and technologies that are better—better for you, better for the planet, and better tech-enabled—in an effort to navigate the post-pandemic world. We are specifically focused on the $60 billion-plus fast casual segment; in our view, this segment maximizes collective benefits distributed across customers (better convenience and value), employees (better opportunities for growth), and shareholders alike (better four-wall economic efficiency and returns on invested capital). Thanks to a digitally savvy customer base (Millennials, Gen Z), we see immediate opportunities for fast casual brands to accelerate unit expansion and significant white-space potential over the next five to ten years.

To this end, this paper is broken into two parts: Part 1: Why Green Circle Is Bullish on the Fast Casual Space After COVID-19; and Part 2: Where Operators and Investors Should Converge Within the Fast Casual Segment to Create the Most Value for All.

Part 1: Why Green Circle Remains Bullish on the Fast Casual Segment After COVID-19

In Part 1, we’ll explore how the greatest disruption in modern times, COVID-19, has affected the restaurant industry. The pandemic has had myriad impacts on the ways in which consumers eat. While the challenges facing the industry in recent months will have long-lasting ramifications, the restaurant industry will survive, just as it has survived every previous crisis, economic or otherwise. We see several key tailwinds that make us bullish on the fast casual segment in years to come.

Supply-Side Tailwinds

When we spoke with Greg Golkin, Managing Partner at Kitchen Fund, he noted “Over the past few years, major industry challenges have plagued all retail brands – specifically high real estate costs, tight labor markets, and dense competition. Within days of COVID-19 hitting the US, each of these forces abruptly reversed course. The pain will be immense for the industry between now and the end of this crisis, but the brands that can persevere will face a landscape primed for growth. Just on real estate alone, brands may be able to add 3% to their store-level margins, and that will be a structural advantage for years to come for those willing to lock into 15+ year leases.”

In spite of some sensational reports early in the pandemic, such as industry veteran David Chang’s prediction, “I’m not being hyperbolic in any way: Without government intervention, there will be no service industry whatsoever”[1], the restaurant industry is not going to die. In fact, most eateries will eventually reopen. Collectively, however, the restaurant industry is expected to lose $240 billion in sales during 2020 resulting from the pandemic.[2] Many restaurants that have closed during this crisis will remain closed permanently; some estimates suggest 20 percent or more stores will see this fate.[3] These permanent closures will be the result of both necessity (e.g. bankruptcy) and choice (e.g. companies that choose not to invest precious pre-opening dollars to reopen locations that were already struggling with poor unit economics pre-pandemic).

The challenges experienced by restaurants have been more pronounced in major urban markets like New York City (NYC). Rob Garrett, CFO of Aurify Brands—the NYC-based owner of Melt Shop, The Little Beet, and Field’s Good Chicken, among other brands— told us, “Assuming that we don’t experience a strong second wave of COVID-19, we expect our NYC restaurants will get back to 80% of their prior sales levels by November or December 2020, with stores rebounding to their 2019 sales levels sometime in early 2021.” While the quick service restaurant (QSR) segment has largely rebounded in other parts of the country, operators in major urban markets continue to see significantly reduced sales volumes.

As a result of the difficult operating environment, we expect industry-wide net new unit growth to remain muted for at least the next twelve to eighteen months. While a few select companies like Sweetgreen have begun to open new locations, many of the largest, company-owned restaurant systems and franchised brands have delayed unit growth plans and/or announced postponements of franchise development obligations this year (e.g. Starbucks, Shake Shack, Yum! Brands, Wendy’s, et al.).

In addition to caution displayed by restaurant operators, conversations we’ve had suggest that a cautious approach is being taken by institutional growth equity investors within the restaurant space. In our conversations with a well-known Private Equity investor, he said, “Based on what we’re seeing in the south and the west, we expect that this is going to go on for at least the next 6-18 months. Now when we underwrite an investment, we need to factor in the acquisition or investment cost, as well as incorporate the business’ cash needs to survive the lingering effects of the pandemic during this 6-18 month period.” As a result, we expect companies’ limited financial resources to be focused primarily on reopening and/or reconfiguring existing units rather than investing in new unit growth in the near-term.

Supply-Side Tailwind 1: More Rationalized Competitive Dynamics for Better Concepts

When it comes to restaurants, consumers have been spoiled in regard to choice in recent years, following twenty-plus years of unit growth, particularly within fast casual. Nevertheless, restaurant supply finally started to peak in 2018 to 2019. “After unit expansion of 8 to 9 percent year after year from 2010 to 2017, fast casual unit expansion slowed, rising 2 percent in spring 2018.”[4]

The proliferation of restaurant concepts over the last two decades created an intensely competitive environment that caused returns on invested capital (ROIC) within the industry to narrow for all but the top brands. While the pandemic will lead to the unfortunate demise of many restaurant units and concepts, the silver lining is that a more rationalized supply base will likely lead to improved competitive dynamics for the brands that do survive. Fewer stores will be competing for the share of consumer dollars spent on food away from home (FAFH). This should allow strong, surviving brands to more quickly bounce back to pre-crisis sales levels.

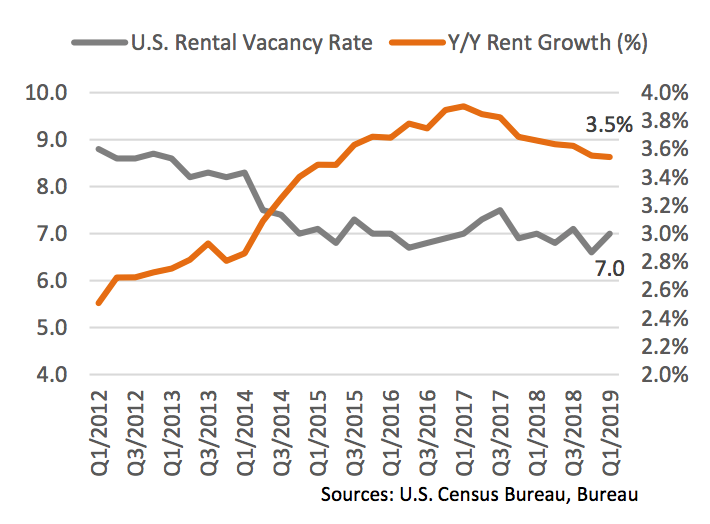

Supply-Side Tailwind 2: Rationalized Real Estate Costs Provide Compelling Expansion Opportunities

Another positive consequence of a more rationalized supply base of restaurants will be more favorable real estate opportunities. In a recent update from Shake Shack, the company stated, “The Company has an identified pipeline of leases in negotiation for continued growth in 2021 and beyond and believes additional and improved development opportunities may be available over time due to the impact of COVID-19 on the overall retail and real estate environment.”[5] Commercial landlords have just recently experienced the first three months of what will likely be several more months of rent delays, abatements, and delinquencies. Commercial rent, which reached peak growth rates a few years ago, had finally seen growth rates plateau, then decline over the past two years.

The glut of empty commercial real estate, particularly within urban markets, has already been front and center for the past two years, driving rent to stabilize. For instance, “the amount of empty retail space in [New York City] climbed to eleven million square feet in 2017, double what it was in 2007.”[6] For landlords, the pandemic only worsened an already precarious situation. “In addition to the countless small retail and restaurant businesses that may be forced to permanently vacate their commercial spaces because they can no long afford them, a growing number of corporate chains is also beginning to prove unwilling or able to pay their rent”[7] These store closures are sure to create an overhang of real estate inventory, leading to lower rent for the surviving chains.

Coming out of the pandemic, we anticipate that the accelerated rate of vacancy caused by the economic hardships facing the restaurant industry will lead to: (1) significantly reduced commercial rent; (2) an abundance of available spaces with key mechanical, electrical, and plumbing (MEP) infrastructure, plus furniture, fixtures, and equipment (FF&E) already in place; and (3) significant tenant improvement (TI) packages that will be made available by landlords who are anxious to fill their spaces.

Andy Peskoe, a leading industry attorney who runs the food, beverage, and hospitality group at Golenbock Eiseman Assor Bell & Peskoe LLP, told us, “We are sure to see a reduction in total restaurants able to operate profitably, but we expect that alternative tenants (specifically retail) will be closing at a rate exceeding hospitality businesses. Thus, the need for forward-looking landlords to partner with their hospitality tenants to help them reopen and help them find a profitable model is critical. These restaurant tenants are the best possible rent payers: The space is already perfectly built out for the current tenant, no broker need be paid, no free-rent construction period will need to be amortized, and no gamble need be made that a new concept might succeed — only the current tenant will have a supportive returning clientele to help with reopening”

Furthermore, our anecdotal conversations with general contractors suggest that the disruptions within the industry have caused slowdowns in restaurant construction. This, in turn, has compelled general and subcontractors to reduce their fees in order to win bids on sparse projects. The competition amongst general contractors for projects could ultimately lead to lower construction costs. “COVID-19 may impact design and construction contracts in a variety of ways, including impacts to supply chains, contractor workforces, designer personnel, and the availability of government inspectors.”[8] Reduced rent and lower out-of-pocket buildout costs will help to improve the unit economics and ROICs of new unit development for brands that have the capital to expand.

Demand-Side Tailwinds: Fast Casual Set to Take Further Share from Other Restaurant Segments

The history of the restaurant industry has been a constant evolution of restaurant brands building better mousetraps (i.e. concepts) to better meet evolving consumer needs. When Steve Ells founded Chipotle nearly thirty years ago, he saw an opportunity to offer higher-quality food, prepared with classic cooking techniques. Customers had previously never had access to this, outside of full-service, dine-in restaurants. However, in order to offer this elevated food at competitive prices to traditional QSR brands, Ells had to do without servers, shrink the size of the store footprint, and send customers to the counter to place their orders. Within this new model, throughput became king. This required efficient make-lines, success across multiple dayparts (both lunch and dinner, in Chipotle’s case) and appealing to a broad base of customers across gender and age lines. The labor and real estate savings spawned by this higher throughput could then be reinvested in providing higher-quality food to the customer at an affordable price. The impacts of COVID-19 will lead to further disruption, and the progressive fast casual segment is best positioned to adjust to this new environment and meet the needs of these consumers.

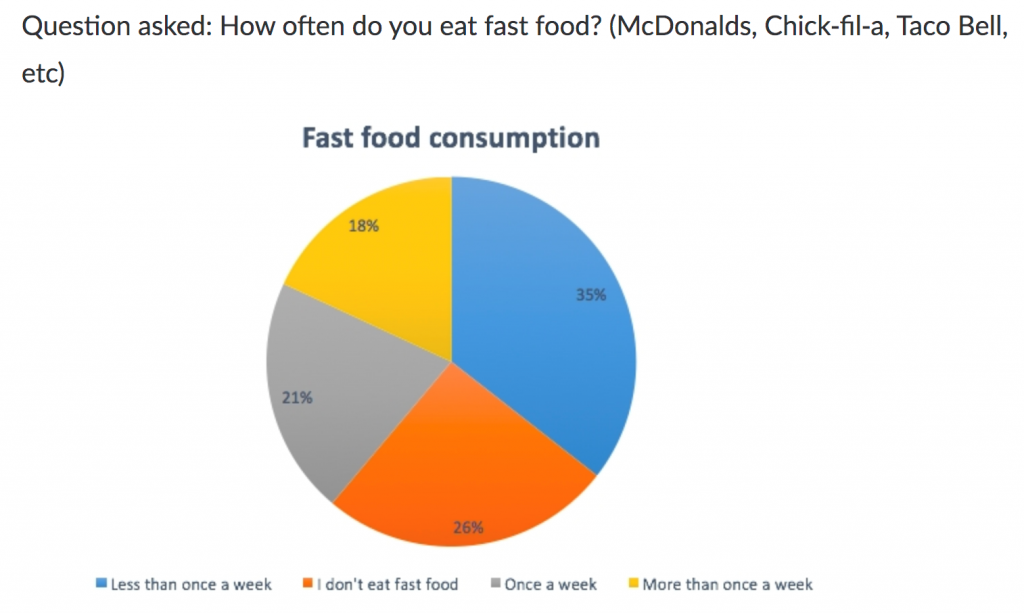

Demand-Side Tailwind 1: Fast Casual Set to Take Further Market Share from Traditional QSR

For generations, the QSR segment has provided customers with a cheap alternative to cooking at home, essentially a home meal replacement service. At the turn of the twenty-first century, coming-of-age Millennials began seeking healthier alternatives to the QSR food their parents fed them growing up. This was a key factor in the creation of fast casual restaurants, which provide fast but more wholesome food at a still-affordable price point, with an sub-$12 average check. Customers began trading up from traditional QSR brands to this new segment of fast casual concepts.

The total dollars spent by Millennials and Gen Z continues to grow versus other age groups, particularly within the restaurant category. We expect consumers from these generations to continue moving away from traditional QSR concepts and to further trade up to healthier fast casual alternatives in the years to come.

Demand-Side Tailwind 2: Fast Casual Taking Further Share from Full-Service Casual Dining

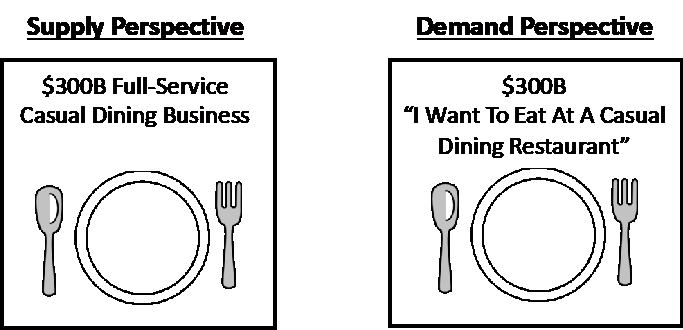

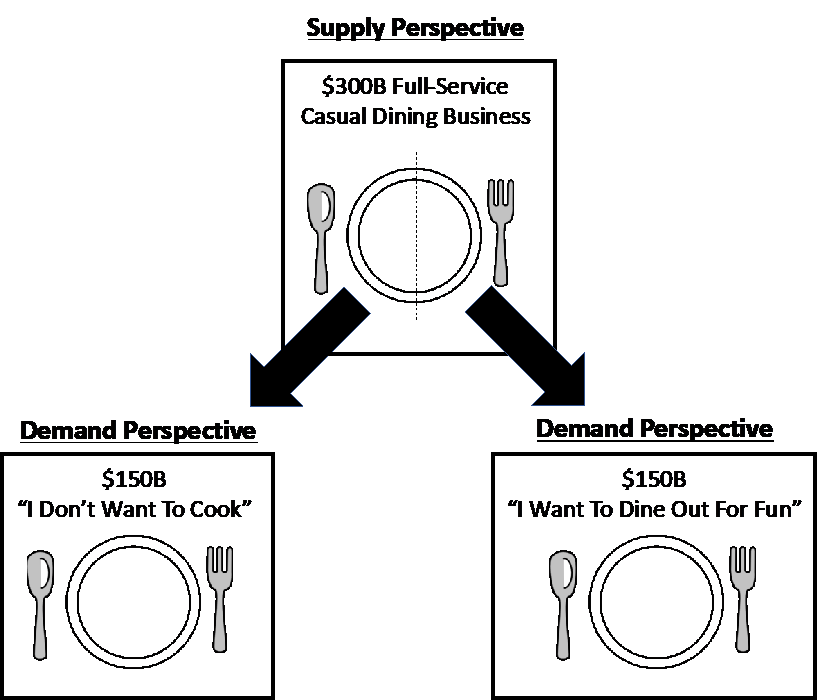

Here is how most people view the $300 billion full-service casual dining sector:

In reality, the casual dining sector is bifurcated into two distinct demand need-states: (1) “I don’t want to cook. Can you help me out?” ($150 billion); and (2) “I want to dine out for fun” ($150 billion).

Over the last two decades, traditional mass-market casual dining brands (e.g. Applebee’s, Chili’s, TGIFriday’s, etc.) lost share to more specialized concepts (i.e. better mousetraps) for both occasions. “I want to dine out for fun” occasions have increasingly been met by polished casual brands (Bartaco, Yardhouse, STK, et al.), concepts that offer nicer environments and allow guests to control the pace of their meals. On the other side of the coin, traditional mass-market brands have largely been usurped by the fast casual segment for the “I don’t want to cook” occasion, offering faster, cheaper meals, with food of equal or better quality.

Demand-Side Tailwind 3: Social Distancing Measures Play to Fast Casual Strength

The “I don’t want to cook” customers’ move toward fast casual is set to accelerate coming out of the pandemic. Experts predict that many social distancing measures put in place during the pandemic will remain even as the economy continues to reopen, potentially stretching into 2022, according to researchers at the Harvard School of Public Health.[9] This means restaurants will likely need to reduce overall seat counts and adhere to reduced capacity restrictions for the near term. Furthermore, we expect that consumers will maintain caution in public spaces, even after restrictions are lifted and normal, pre-pandemic life is allowed to fully resume. As a result of these factors, we expect the “I don’t want to cook” occasion to be further disintermediated away from the casual dining segment, with the fast casual sector reaping most of the benefits when restaurants reopen. This is particularly true for digitally savvy, young consumers who had already begun to gravitate toward fast casual brands that offered digital ordering solutions even prior to the pandemic.

Demand-Side Tailwind 4: Pent-Up Demand Likely to Skew Toward Fast Casual

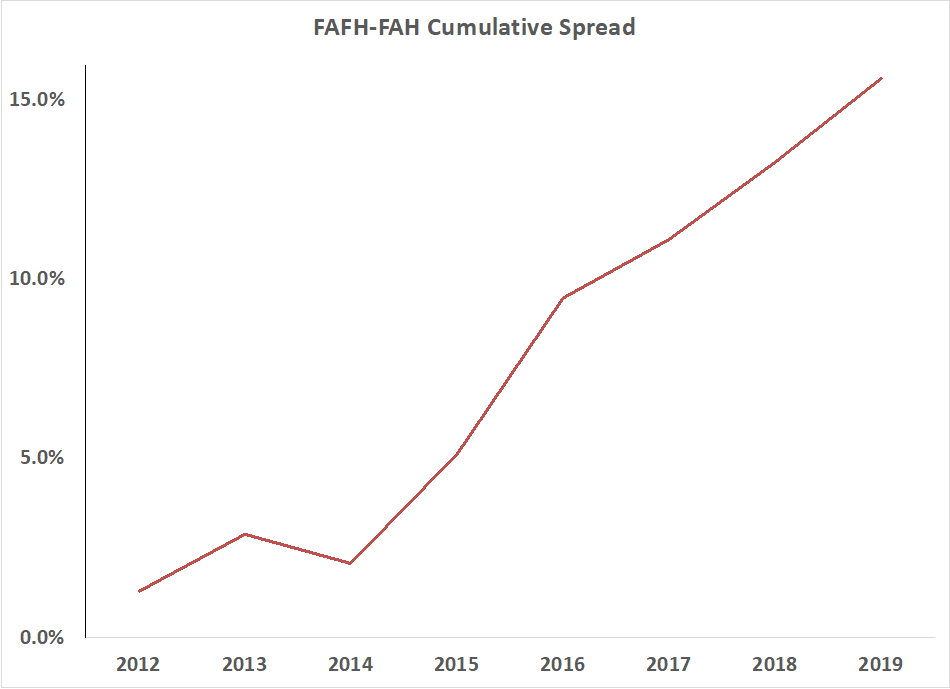

Following months of stay-at-home orders and cooking at home, we expect the bulk of visits based on pent-up demand to go to fast casual restaurants rather than full-service restaurants. There are a couple of reasons for this: (1) the aforementioned caution in public places; and (2) the relative high cost of dining out. The spread between the cost of food away from home (FAFH) versus food at home (FAH) has risen dramatically since 2011. In other words, prices at restaurants have grown at a much faster pace than prices in grocery stores over the last decade, and this disparity has been on full display to consumers during lockdowns, where forced sheltering at home has caused them to notice their savings on previous dining-out expenses.

The realization of the pricing disparity between restaurants and grocery stores could have long-term impacts on customers’ willingness to spend significant portions of their income on dining out, particularly in the aftermath of the devastating, accompanying economic recession. As a result, we expect customers to gravitate to more value-oriented meals away from home at fast casual restaurants, particularly in the six to eighteen months following the reopening of the economy.

In Part 2, we’ll explore where operators and investors will find the greatest value-creation opportunities within the fast casual space, as well as where Green Circle will focus our time and attention in the months and years to come.

Part 2: Where Operators and Investors Should Converge Within the Fast Casual Segment to Create the Most Value for All

In Part 1, we laid out our thesis for why we are bullish on the fast casual segment coming out of the COVID-19 pandemic and economic crisis. In Part 2, we will explore where we believe investors and operators can find the best opportunities for value creation. Green Circle is focused on fast casual brands that are better—better for you, better for the planet, and better tech-enabled to navigate the post-COVID-19 world.

Better-for-You Brands

Green Circle focuses exclusively on better-for-you brands, given our belief that these are best aligned with changing consumer preferences that we expect to continue for decades to come. These companies also tend to embrace shared values that are well aligned with our personal ones, in regard to social responsibility, sustainability, etc.

However, in addition to the well-established, better-for-you wave that CPG and restaurant brands have ridden over the past decade, we see specific opportunities coming out of the COVID-19 crisis that will drive further demand for better-for-you restaurant companies.

Better-for-You Food: Nothing has brought the health of our citizenry to the forefront in such a compelling manner as this most recent pandemic. Coming out of this crisis, we anticipate an even greater emphasis on health and wellness from consumers who are anxious to resume healthy, active lifestyles. The renewed focus on health will be a boon for better-for-you fast casual concepts, which have an opportunity to become a part of consumers’ weekly routines once again. While meat prices have seen recent spikes as a result of temporary supply disruptions, forecasts from the USDA call for more muted commodity price inflation over the next year.[10] Within a more modest commodity price inflation environment, restaurants should be able to source high-quality, sustainably raised ingredients without hurting margins or forcing significant price increases.

Health and Safety: In a post-COVID world, better-for-you food goes beyond ingredients. Companies throughout the industry, large and small, have implemented new health and safety policies and guidelines, widely following guidance and directives from governmental authorities.[11] In order to win trust with guests, it is crucial for businesses to update their operating procedures, including but not limited to: employee temperature checks before each shift, masks for employees, and more stringent food safety and sanitization protocols. The brands that most quickly and thoroughly implement these operational overhauls will be better positioned to earn the trust of a fragile U.S. consumer base.

Better-for-the-Planet Brands

Over the past decade, there has been a proliferation of environmental consciousness and activism that goes hand in hand with the better-for-you movement. This trend has been apparent in the restaurant industry, where brands have put their environmental bona fides on display to build stronger connections with environmentally conscious customers. These themes resonate deeply with Millennials and Gen Z consumers, and it bears consideration that Millennials are now becoming the generation with the greatest purchasing power in the country. “As they hit prime spending years, Millennials are looking to put their money where their values are.”[12]

Coming out of the crisis, we anticipate an even greater affinity from customers for brands with a better-for-the-planet ethos.

Sustainable Agriculture: In recent years, younger consumers have exhibited some rebellion against America’s broken factory farming system. Research suggests that “they have the highest consumption rates of organic and non-GMO food and beverages, demanding authenticity, freshness, and purity. They, in part, reflect some defining characteristics of their Millennial parents, who took issues such as animal welfare, fair trade, sustainability, ethics, and the environment, and focused them on food and agriculture.”[13] This trend toward sustainable agriculture is likely to accelerate, with the COVID-19 crisis further exposing how our broken food system is putting the world population in danger from infectious, zoonotic diseases, as well as other health crises and the adverse effects of climate change.

Building an Employee- and Community-Centric Culture: There has been a spotlight on employment practices within the restaurant industry in recent years. Many have noted the difficult work environments and substandard wages, among other challenges. In response, many restaurant brands have made it a priority to foster employee-centric cultures with better employee benefits (higher pay, education reimbursement, vacation/sick leave, flexible scheduling, etc.). Many of these brands have taken similar strides to be good corporate citizens by becoming part of the fabric of their local communities. Particularly in light of the hardships caused by COVID-19, brands that demonstrate a commitment to their employees and communities stand to benefit from increasing customer affinity.

Charitable Giving: Some of the most inspiring stories to come out of the crisis have been the outpouring of support for healthcare and essential workers, along with other community initiatives. Riding this wave of charity and gratitude, customers are likely to actively seek out brands that invest in programs that have a positive impact on their communities and the planet at large. This includes initiatives such as supporting impoverished and food-insecure communities, food banks, farm-to-table trends, and hospital/service workers, among others.

Better Tech-Enabled Brands that Can Flourish in the Post-COVID-19 World

Green Circle’s third criteria for success requires us to seek out brands that are better tech-enabled and, thus, better equipped to navigate a post-coronavirus world. While many of these tech trends were already at the forefront of the restaurant industry pre-crisis, we anticipate that they will take on a new, more urgent meaning post-crisis. We believe that in the new normal, many more innovations will arise. From this chaotic period, we will see creative scientists, engineers, and businesspeople solve some of these novel dining-out challenges with new and inspiring tools.

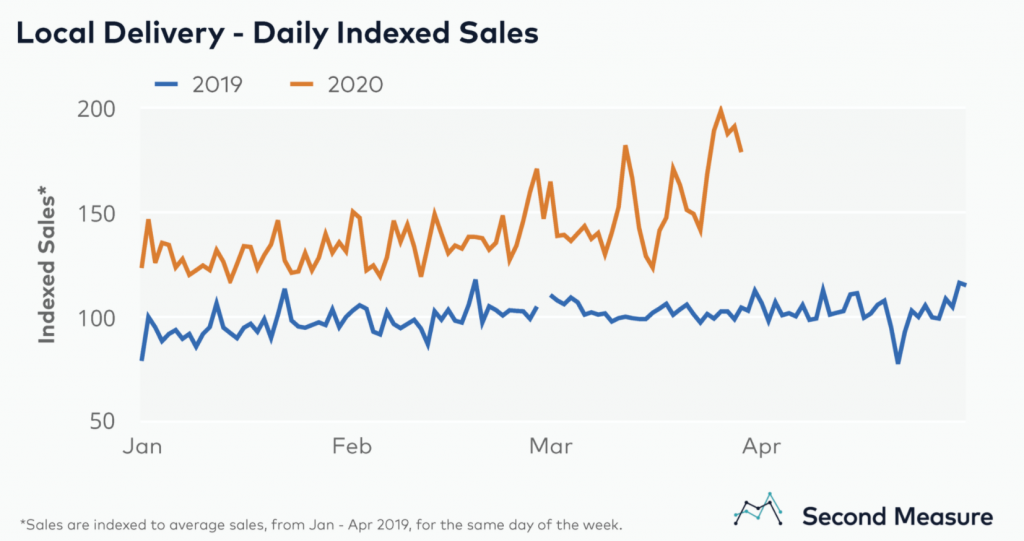

Off-Premise Innovations in Delivery, Contactless Pickup, and Drive-Thru: The off-premises channel (delivery/takeout) has become a driving force for brands working to survive the disruptions caused by the pandemic. When we discussed this topic with Nick Stone, Founder and CEO of Bluestone Lane, an Australian-inspired coffee, café, and lifestyle brand, with over fifty stores in the U.S., he said, “Prior to COVID, delivery was 5 percent of our total sales mix. Currently, it’s 50 percent of total sales, reinforcing how dramatic the change in operations has been in this new world.”

Delivery has been an enigmatic, rapidly-evolving force in the restaurant industry in recent years, with the potential to unlock significant untapped customer demand, offset by unsustainable costs associated with the service. This is particularly true of third-party ordering/delivery fees. “Restaurants can pay commission fees as high as 30 percent on orders delivered by third-party aggregators like DoorDash and Grubhub.”[14] While we expect many of the same challenges to persist, we see COVID-19 and the resulting lockdowns as having made delivery incrementally more viable for restaurants.

From a demand perspective, GrubHub and other platforms have reported record numbers of new customers ordering online for delivery during the lockdowns. GrubHub noted on its 1Q20 earnings release: “We are also seeing record numbers of new diners and new restaurants on the platform.”[15] This opens up a brand new customer base for restaurants to target when they reopen.

With the likelihood of lingering fear of going out to eat in public, we expect there to be a more prevalent willingness from customers to cover the costs of delivery, allowing restaurants to pass through more of those fees. Additionally, recent caps on third-party fees passed in major urban markets around the country make delivery transaction economics more palatable for restaurants; that said, it remains to be seen the impact these caps will have on delivery volumes.[16]. This could also lead to a push by fast casual brands into new ghost kitchen locations, perhaps far more rapidly than previously anticipated. “In a time of social distancing and escalated concern for health and safety, ghost kitchens provide opportunities for restaurants to provide value to consumers while limiting risk.”[17] It is crucial, therefore, that fast casual brands have strong systems in place (streamlined online ordering, second back-of-house production lines, speed, reliability, etc.) to handle delivery coming out of the crisis.

Beyond just delivery, the rapid adoption and increased utilization of contactless pickup and the recent move by fast casual brands toward drive-thru lanes will continue to support sales during the transition period while consumers remain less eager to dine in with other customers. Notably, Chipotle has frequently called out drive-thru and pickup as the highest margin sales channels for the brand.[18]

Companies that offer a better, more tech-enabled mobile ordering process stand the best chance of creating a seamless ordering and contactless pickup solution to cater to these customers. Avoiding friction in ordering systems will lead to more orders, and smooth execution at the restaurant will lead to greater repeat orders, as well as a sustained lift in related sales.

Streamlined Labor Model Is Key to Success

For restaurants that have chosen to remain open during the pandemic, the key to success has been a rapid reduction in store labor, often coupled with reduced menu offerings. According to FSR Magazine, “Another area of significant simplification has been with the menu. A limited menu that focuses on the most popular sellers allows customers to quickly make a decision and order. It’s also easier and faster to produce with a limited staff so orders can be executed quickly without mistakes. Reducing the menu has also led to a reduction in the number of SKUs in the kitchen, which has made it easier to manage inventory and place orders for ingredients.”[19]

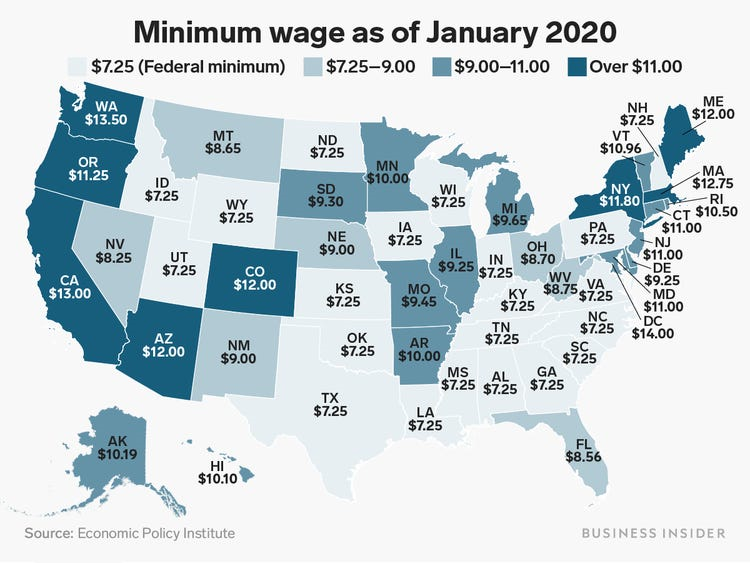

The brands that have been able to execute in this environment are those that had already built their businesses so as to leverage limited labor overhead. In a world that had already seen a rapid rise to a fifteen-dollar hourly minimum wage in many markets, labor costs will remain a key factor in the success of companies in the years to come. The highest-performing restaurant stocks over the past few months during COVID-19 have trended toward being those with the lowest labor costs as a percentage of sales prior to the pandemic — Industry: 30 to 35 percent versus WING: 23 percent; CMG: 27 percent; and DPZ: 29 percent. It will be crucial for brands to optimize their menus and store designs to reduce the amount of labor needed to operate, particularly in times of industry disruption.

Closing Thoughts: Where Do We Go from Here?

Even with the economy reopening in stages over the coming months, restaurants should be prepared for future disruptions. For instance, at the time of the publication of this paper, we are seeing significant case spikes in various states amidst a new resurgence of the virus. This could conceivably lead to more or repeat shutdowns. It is essential that restaurants utilize this time to effectively prepare for continued difficult times ahead. This includes becoming better tech-enabled, changing operating protocols for enhanced health and safety, streamlining labor models, paying down debt, and bulking up cash reserves to the best of their ability.

There will be more challenges ahead for restaurants in the months to come, but from chaos comes opportunity, and Green Circle is here to support and partner with innovative restaurant brands who are working tirelessly toward providing a better future for their customers. If you run a fast casual chain that could be at the forefront of such a movement, or if you are an investor interested in partnering with such potential leaders of the next wave of restaurant success stories, please give us a ring. We deliver!

- By Mike Vieten, CFA, Managing Director – Restaurants, Green Circle Capital, (with research support from Ellie Kozol) July 1, 2020

About the Author: Mike Vieten has spent his career analyzing, investing in and operating food & beverage businesses. Mike is a CFA charterholder. He received his MBA from Columbia Business School, and his Bachelor of Science degree from Columbia University’s School of Engineering and Applied Sciences.

Email: mike@greencirclecap.com

646-875-4870

[1] David Marchese, “David Chang isn’t sure the restaurant industry will survive COVID-19.,” New York Times Magazine, March 27, 2020, https://www.nytimes.com/interactive/2020/03/27/magazine/david-chang-restaurants-covid19.html.

[2] Alicia about:blankKelso, “Restaurant industry expected to lose $240B by the end of 2020,” Restaurant Dive, June 16, 2020, https://www.restaurantdive.com/news/restaurant-industry-expected-to-lose-240b-by-the-end-of-2020/579857/.

[3] Kate Taylor, “RESTAURANT APOCALYPSE: One in 5 restaurants in the US could permanently close because of the coronavirus pandemic, putting millions out of work,” Business Insider, Alicia Kelso, “Restaurant industry expected to lose $240B by the end of 2020,” Restaurant Dive, June 16, 2020, https://www.businessinsider.com/1-in-5-restaurants-could-close-due-to-coronavirus-ubs-2020-4

[4] Bonnabout:blankie Riggs, “Still Too Many Restaurants,” Restaurant Finance Monitor, http://www.restfinance.com/Restaurant-Finance-Across-America/January-2019/Still-Too-Many-Restaurants/.

[5] “SHAKE SHACK PROVIDES FIRST QUARTER 2020 PRELIMINARY RESULTS,” news release, https://www.sec.gov/Archives/edgar/data/1620533/000110465920047964/tm2016184d2_ex99-1.htm.

[6] Julia Marsh, “Vacant retail space has doubled in NYC over 10 years,” New York Post, September 25, 2019, https://nypost.com/2019/09/25/vacant-retail-space-has-doubled-in-nyc-over-ten-years/.

[7] Connie Loizos, “Commercial real estate could be in trouble, even after COVID-19 is over,” TechCrunch, https://techcrunch.com/2020/04/08/commercial-real-estate-could-be-in-big-trouble-even-after-this-is-all-over/?guccounter=1.

[8] “For Developers and Owners: How COVID-19 Is Affecting Construction Projects and Actions You Should Consider,” The National Law Review, April 15, 2020, https://www.natlawreview.com/article/developers-and-owners-how-covid-19-affecting-construction-projects-and-actions-you.

[9] Reuters, “Social distancing may remain in place until 2022, Harvard researchers say,” NBC News, https://www.nbcnews.com/health/health-news/social-distancing-may-remain-place-until-2022-harvard-researchers-say-n1184396.

[10] “World Agricultural Supply and Demand Estimates at a Glance,” United States Department of Agriculture Economic Research Service, https://www.ers.usda.gov/topics/farm-economy/commodity-outlook/wasde-projections-at-a-glance/.

[11] Guidance on Preparing Workplaces for COVID-19, https://www.osha.gov/Publications/OSHA3990.pdf.

[12] Caitlin Mullen, “Gen Buy: Millennials projected to spend $1.4 trillion as influence grows,” Bizwomen, https://www.bizjournals.com/bizwomen/news/latest-news/2020/01/gen-buymillennials-projected-to-spend-1-4-trillion.html.

[13] “Is U.S. Agriculture Ready for Generation Z?” Farm Bureau, https://www.fb.org/viewpoints/is-u.s.-agriculture-ready-for-generation-z

[14] Amelia Lucas, “DoorDash eliminates and reduces some commission fees for restaurants,” CNBC News, https://www.cnbc.com/2020/03/17/doordash-eliminates-and-reduces-some-commission-fees-for-restaurants.html

[15] “Gruabout:blankbhub Provides Business Update And Timing Of First Quarter 2020 Earnings Announcement,” news release, https://investors.grubhub.com/investors/press-releases/press-release-details/2020/Grubhub-Provides-Business-Update-And-Timing-Of-First-Quarter-2020-Earnings-Announcement/default.aspx.

[16] Eve Batey, “San Francisco Emergency Order Says Delivery Apps Must Cap Restaurant Fees at 15 Percent,” Eater San Francisco, https://sf.eater.com/2020/4/10/21216546/san-francisco-delivery-cap-doordash-grubhub-uber-eats-postmates-caviar.

a. Lauren Feiner, “New York City Council votes to cap food-delivery app fees at 15% during states of emergency,” CNBC News, https://www.cnbc.com/2020/05/13/nyc-city-council-votes-to-cap-app-delivery-fees-at-15percent.html.

b. Gabe Guarente, “Seattle Issues Emergency Order to Cap Delivery App Fees for Restaurants at 15 Percent,” Eater San Francisco, https://seattle.eater.com/2020/4/24/21235317/seattle-emergency-order-cap-restaurant-delivery-app-fees-15-percent.

c. Gabe Hiatt, “Emergency Bill Limits How Much Delivery Apps Can Charge D.C. Restaurants,” Eater Washington DC, https://dc.eater.com/2020/5/5/21248534/dc-bill-caps-delivery-fees-commissions-grubhub-caviar-doordash-postmates-ubereats-restaurants.

d. Ashok Selvam, “Chicago Considers Capping Delivery App Fees for Restaurants at 5 Percent,” Eater Chicago, https://chicago.eater.com/2020/4/22/21231053/chicago-restaurants-delivery-cap-doordash-grubhub-uber-eats-postmates-caviar.

e. Farley Elliot, “Los Angeles Likely to Force Delivery Apps to Cap Restaurant Fees at 15 Percent,” Eater Los Angeles, https://la.eater.com/2020/4/23/21233175/los-angeles-restaurant-delivery-app-fee-cap-coronavirus-15-percent.

[17] Danny Klein, “Is COVID-19 Going to Accelerate the Ghost Kitchen Craze?,” QSR Magazine, May 2020, https://www.qsrmagazine.com/customer-experience/covid-19-going-accelerate-ghost-kitchen-craze.

[18] Heather Lalley, “CHIPOTLE SEES SAME-STORE SALES SOAR 13.4% IN Q4,” Restaurant Business, February 5, 2020, https://www.restaurantbusinessonline.com/operations/chipotle-sees-same-store-sales-soar-134-q4.

[19] Tim Hand and Bruce Reinstein, “COVID-19 for Restaurants: What’s Working and What Will Become Part of the New Normal,” FSR Magazine, April 2020, https://www.fsrmagazine.com/expert-takes/covid-19-restaurants-whats-working-and-what-will-become-part-new-normal.