Enhancing Enterprise Value In VMS/Nutraceutical Businesses

(A Green Circle Capital White Paper, November 2017)

Introduction:

The VMS/nutraceutical industry is growing at a very healthy rate, exceeding that of other consumer non-durables such as food and beverages and dramatically outpacing growth of the sluggish overall American and global economies. Certain segments are growing faster than others. Sports nutrition leads the pack, with a 10.2% compounded annual growth rate (CAGR) over the last 5 years, with meal replacement at 9.3%; herbs and botanicals at 6.9%; and specialties, including products containing ingredients such as probiotics and omega-3 oils, at 5.9%.

VMS/Nutraceuticals in the United States has grown from a $14.9 billion in industry in 2000 to over $41.1 billion in 2016, according to the Nutrition Business Journal. This is a compounded annual growth rate of 6.8%, which compares very positively to food and beverage compounded growth of 3.4% over the same timeframe. This growth has been driven by strong demographics, expanded distribution, and product innovation, and we expect all three trends to continue to contribute to growth going forward.

What follows is a brief summary of what Green Circle Capital sees as primary drivers for growth, current trends and opportunities for companies in the space to enhance enterprise value, and a summary recap of recent M&A activity. Our hope is that this guide will be a useful tool for business owners and executives, as well as vendors and partners of such companies.

I. Tailwinds for the VMS/Nutraceutical Industry

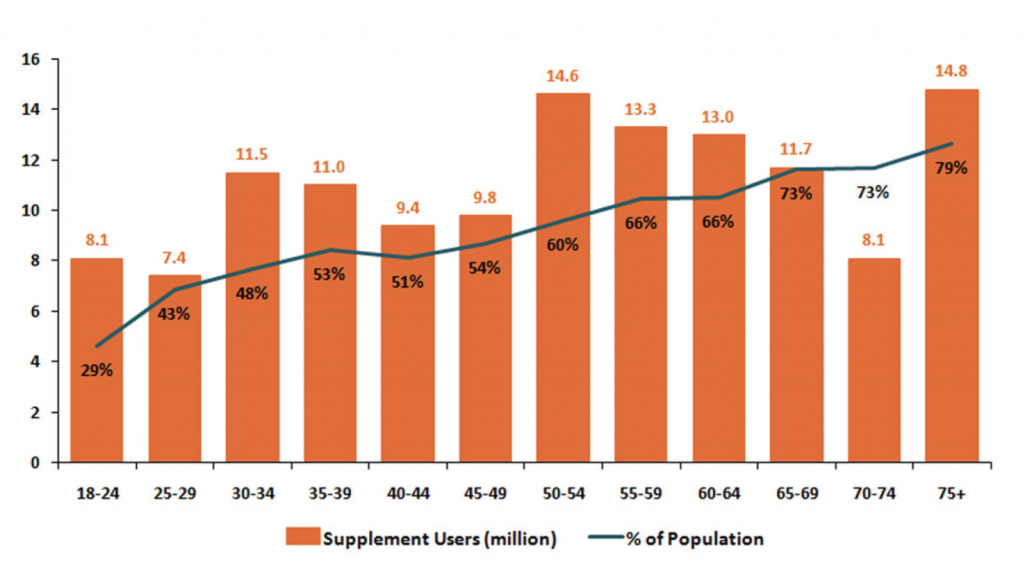

1. Aging of America Supports Continued Growth

The rate of nutraceutical use increases with age. The aging of America is the largest contributing factor behind continued strong growth in the industry. Nutraceutical World suggested in a recent article that the percentage of nutraceutical users increases from approximately 45% for those under 45 to over 70% for those over 65. The share of the U.S. population over 65 will increase to over 19% in 2030 from 13% in 2010, according to the U.S. Census Bureau. This shift will bring an additional 32 million people into the over-65 category and should drive incremental nutraceutical adoption.

Older people spend more on healthcare. Many studies, including the Medical Expenditure Panel published by the Agency for Healthcare Research and Quality, a division of the U.S. Department of Health and Human Services, show that older Americans pay considerably more in out-of-pocket healthcare costs than younger Americans. This further suggests that, despite comprehensive medical coverage in the form of Medicare, older people still spend more of their money out of pocket on healthcare than younger members of the population do, approximately $1,200 versus $700 per person per year on average, according to the Panel.

2. Adoption of Products by Millennials Will Further Support Growth

Perhaps the second-most impactful demographic factor supporting growth in the industry is adoption by younger, Millennial consumers. Acquirers in the space are focused on products that connect with these consumers. Data from the National Center for Health Statistics shows that over the last 30 years, the percentage of adults over 20 years old that use vitamins and supplements has increased from just under 30% in a survey conducted between 1988 and 1994 to 54% in the most recently available survey, ended in 2014. We believe this trend toward wider adoption will continue.

Indeed, Millennial consumers are already an area of focus and opportunity for industry participants. Genesis Today was once a high-flying brand that experienced problems and saw revenues decline sharply. After executing on substantial changes to the business and bringing in new management, the company has achieved a turnaround and is growing again at a healthy rate, outperforming in the category. CEO Bill Meissner said, “We consider Millennials to be very important. They over-index on VMS relative to other demographic counterparts and, particularly for us, with our plant-based, non-GMO, organic products, they are right in our bull’s-eye.” Meissner also pointed out that Millennials are an important target for two of the company’s three main product categories, Heath & Nutrition and Superfoods. “They want to see authentic communication via digital media and engage with companies that are participating in meaningful causes. At Genesis Today, we find the Whole Planet Foundation to be doing very interesting work. They provide micro-loans to underserved, third-world societies for entrepreneurship and farming. There are many great cause-based programs a brand can affiliate with. Since we source superfoods from all over the world, this one connected with us, and we believe it resonates with our consumers,” Meissner added.

Young advocates will lead the way. The most interesting consumers are young advocates, the people who spend time online reading about nutrition and fitness and evangelizing with their findings, becoming important de facto ambassadors for certain brands and products. They try new things and are committed to spending money on wellness and nutrition products. Some, though not all, are also exercise enthusiasts. It is our belief that these younger users will lead the natural products adoption arc and increase supplement use with age. This can set the stage for strong tailwinds into the next twenty to thirty years.

Acquirers are eying younger demos. The dynamic in nutraceuticals contrasts with many other industries where purchasing often declines with age (think sneakers) and young customers must constantly be replaced with new ones in order to keep sales strong. In this industry, we see the opportunity for brands to educate and enroll consumers, then retain those customers for many years. Smart acquirers, therefore, are looking to tap trends in younger consumer groups and ride the wave with them.

Specialization Within Demographic Groups. “All this being said, it’s important to recognize that within both Millennials and Baby Boomers, there is a large spectrum of individuals,” points out Beverly Emerson, President of Olive Tree Product Development, a consultancy in Seattle, Washington. As an example, Emerson offers: “With 40% of American adults now considered obese, the battle for weight management continues. We know that obesity is the precursor to a majority of real health issues, and that is where the real opportunity lies, lifestyle medicine—teaching people how to change their lifestyle, helping them actually do it, and providing the products and services to support them.”

3. Varying Degrees of Growth

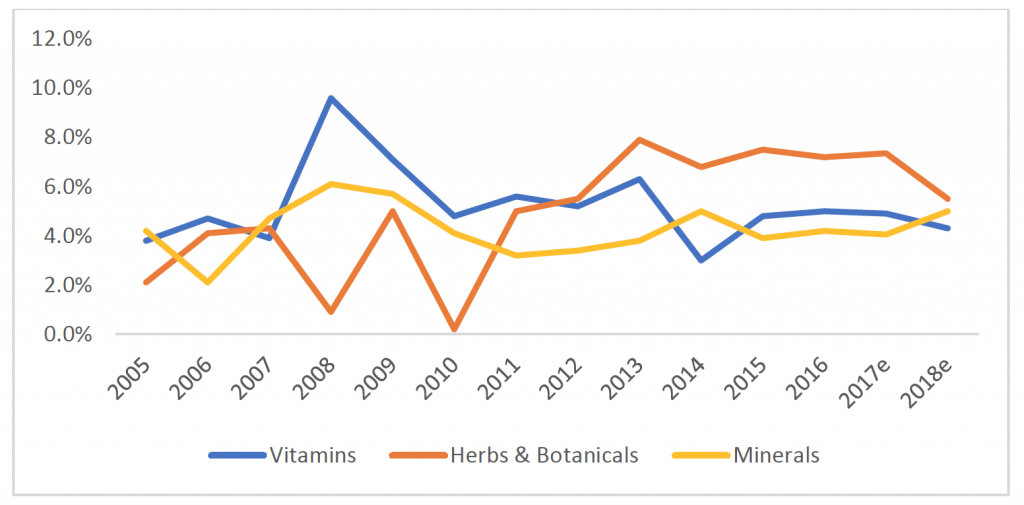

Despite tremendous growth in the overall nutraceutical industry, are vitamins poised for deceleration of growth or even eventual declines? Vitamins presently account for just over 30% of VMS/nutraceutical industry sales, according to the Nutrition Business Journal and anecdotal Green Circle estimates. However, growth has been slower than the industry at perhaps 5.6% over the last ten years. It has been even slower over the last five years, at 4.8%. Over that time, the vitamin market share of the VMS/nutraceutical category has dropped from 33.4% to 31.2%.

It is also important to point out that this industry is subject to exogenous shock. Case in point: In 2008, a series of articles, both scientific and popular, touted the benefits of Vitamin D, and it caught on with the U.S. population in a significant manner. It led to ~10% growth in the whole vitamin category in 2008, a 600-basis point acceleration from the year before. In late 2013, a Johns Hopkins study, “Enough Is Enough: Stop Wasting Money on Vitamin and Mineral Supplements,” claimed that most vitamins produce no benefits at all, and sales slowed considerably. These short-term impacts on revenue, arising from media reports, regulatory changes, etc., are not uncommon, and we recommend that producers focus on compounded growth over a number of years when building financial forecasts and long-term business plans.

The situation with vitamins may be analogous to two other enormous consumer products categories: carbonated soft drinks and mainstream lager beers. Carbonated soft drinks have seen volume contract every year for the last 12 years, culminating most recently in a 1.2% decline in 2016. Similarly, the five largest beer manufacturers and importers have seen their market share decline from 92.8% in 2009 to 82.5% in 2015, according to Beer Marketer’s Insights. There are a few important things to note:

- These declines are reasonably slow on a year-over-year basis and, therefore, are less impactful to cash flow than market perception.

- The declines are material, and all major industry participants have adjusted course to increase growth in other areas and compensate for declining sales of core, legacy products, as well as the risk of accelerating declines going forward.

- With domestic sales of beer exceeding $100B, each point of lost market share represents over a billion dollars in sales being absorbed by startups. Losing 10.3% of market share means that in less than ten years, big beer has given up around $11 billion in annual sales to upstarts. That’s a lot of micro-brew!

- The tremendous cash flow that comes from the large, mainstream brands is being used to fund acquisitions in specialized areas.

For the world’s mammoth beer companies, lead by AB InBev, it’s been an all-out land grab to acquire the better craft beer manufacturers once they separate themselves from the large field of emerging startups by achieving some scale. When they do, multiples have routinely been north of twenty times EBITDA and often twenty-five, thirty, or even higher. As consumers seek smaller, specialized, and what they perceive to be more authentic brands, industry leaders follow, acquiring such businesses in an attempt to retain overall market share.

In the case of soft drink companies, while soda sales have declined every year for a decade and seem to be facing headwinds reminiscent of cigarettes in the 1990s, perhaps most prominently in North America, Coke, Pepsi and DPSG have been scrambling to diversify into healthier, more specialized alternatives. This is evidenced by Coke’s acquisition of Honest Tea, Pepsi’s deal for sparkling kombucha manufacturer Kevita, and DPSG’s recent acquisition of Bai, maker of natural and five-calorie alternatives to soda.

Trends in vitamins echo what’s happening in these larger consumer categories, as vitamin sales have slowed from compounded annual growth of 6.8% between 2007 and 2011 to 4.8% between 2012 and 2016. Many industries would covet 4.8% growth, and we remain bullish on the prospects for the category. Nevertheless, this growth trails the significant, accelerating growth rates enjoyed by other sub-segments of the overall industry in recent years.

Multivitamins are slowing things down. Focusing more specifically on multivitamins, we see these trends on an even more pronounced basis. Multivitamin sales have grown at a pedestrian 2.9% compounded over the last five years. Consumer usage of Vitamin D, Vitamin A, and other specific vitamin types have well outpaced the multivitamin over the last ten years, and we expect this trend to continue.

According to numerous industry experts, modern consumers are looking for two things: differentiated products and brands with authenticity and social proof. As noted by NBJ, “All of this points to greater consumer trends—clean ingredients, plant proteins, non-GMO, even around personalized nutrition—coming to play in the broader multivitamin market.” Justin Prochnow is an industry expert and attorney with Greenberg Traurig’s Denver office, where he focuses on servicing natural products clients. Mr. Prochnow observes, “Anything with probiotics is popular. The ability of some companies, like Ganeden, to get GRAS status for probiotics has helped with the utilization of it.” Prochnow adds, “Turmeric continues to be a highly sought after ingredient because of its ability to address inflammation.” Some manufacturers of multivitamins are also diversifying and innovating in different ways. “Most of the companies that sell multivitamins already have a portfolio of other products that they market. However, for those who remain focused exclusively on multivitamins, some are branching into different delivery technologies and systems, such as gummies and liquids,” said Ginni Garner, Managing Director of The Garner Group, a division of Sanford Rose Associate, an executive recruitment firm specializing in Consumer Health and Nutrition.

In a world where consumers are increasingly buying with their hearts and avoiding products identified as mainstream, large corporate manufacturers and marketers of multivitamins find themselves in the crosshairs. There was a time when being a leading brand was a point of attribution. Fifty and sixty years ago, a product reaped benefits by coming from a large, global brand; now, this has been turned on its head. Many consumers seem to distrust products from large manufacturers: Think packaged foods. This leaves Bayer (One A Day), NBTY (Nature’s Bounty), Perrigo (private label), Pharmavite (Nature Made), Pfizer (Centrum), and others with cash flow but generally slow growth in one of their core business lines. Considering that each of the aforementioned companies is estimated to have at least $250 million in annual revenues from vitamin business, one might reasonably extrapolate that each generates vitamin EBITDA of at least $20 to $30 million per year, if not far more. This frees up considerable free cash to deal with, and we anticipate this to be a driving factor in acceleration of M&A activity in the space in the coming months and years. That bodes well for smaller manufacturers of niche products. That said, Prochnow points out that it is also becoming more important than ever for manufacturers to have, “…better research and science to support claims. Claims are becoming more and more under the microscope, and companies must have good science.”

II. Enhancing Enterprise Value

1. Be Specialized and Authentic

Specialization and authenticity carry the day. The nutrition business is faddish by nature, and saying that a certain category like brain health is hot may be true, as it was in 2016, but it is not necessarily a good predictor of what will be hot in 2021 or even 2018. Therefore, we must utilize a shorter horizon when assessing industry trends in this space versus other consumer-facing industries.

“For supplement makers, the key to success in this personalized nutrition world is to innovate and personalize beyond the generic catch-all multi line and develop formulations that target specific consumer groups with specialized lines in all the formats that consumers demand.”

This is a quote from the 2016 “NBJ Supplement Business Report.” Other industry contacts and independent research confirm that specialized products are perceived to have a higher value in the eyes of consumers and potential acquirers. A recent example is collagen marketer NeoCell. The company was founded by Al Quadri when he sought and found a solution to fatigue and other problems after a major heart surgery. The company has been focused on collagen ever since. It branched into different uses and delivery mechanisms while staying true to the core ingredient and the mission of improved health through collagen. The company has seen tremendous growth over the last five years, growing at double-digits since 2008. Neocell was acquired in the summer of 2017 by WellNext, makers of Rainbow Light and other vitamin products, though the terms of the deal were not disclosed.

2. Product Customization Unlocks Additional Growth Opportunities

Growth in the nutraceutical industry has recently been led by categories such as brain health, protein supplements, and sleep aids. The days of one-a-day vitamins are gone for many consumers. They tend to seek help for more specific conditions, such as needing more energy or to better focus at work. Historically, the industry has always been subject to fads, with new products and concepts leading growth for a period before falling back. As is also the case in other wellness businesses, staying on trend is critical to maintaining sales momentum.

Indeed, with the complexity of the industry, it is difficult to forecast which segments will be hot next. We are, however, confident that there will continue to be shifts in consumer spending as new science is released and new trends emerge. Currently, homeopathic remedies, plant-based treatments, and supplements derived from whole foods are gaining momentum. At the same time, previously red-hot superfoods and superfood supplements have cooled some.

One of the trends in healthcare is a general leaning toward customization. Consumers seek treatments tailored to their specific personal needs and tend to shy away from even proven and viable products if those products are seen as too broad in their indications or as coming from un-trusted authorities.

Creating products that address more specific consumer needs can lead to traction and success. This differentiates smaller producers and marketers and can also create the perception of an added value to investors or strategic acquirers. Indeed, Ernesto Carrizosa, Executive Managing Director at WM Partners/Wellnext, which recently made the news for their acquisition of Neocell, told us that his firm vets tons of VMS/nutraceutical companies. He also mentioned, “The ones that justify a premium are playing in specific niches in competitive and growing segments.” Notably, he said that those that also have sufficient scale and volume become truly unique due to their generally superior margins. “In any maturing industry, we see a focus on specialized products,” added Carrizossa.

We share this view and believe focus and long-term thinking are beneficial to the creation of value. Another example of this phenomenon is the 2016 acquisition of Renew Life Formulas by The Clorox Company. Renew Life has been focused on intestinal health since its creation in 1997. The company has maintained that message over time, and the category itself rose with it. Clorox paid a healthy 2.5x sales multiple in a $290 million transaction, versus a multiple to revenues for the industry, typically below 2x sales.

Renew Life has a target audience with an identifiable need, and their products offer solutions: Gut health issues are addressed with probiotics and other items in the product array. The company had multichannel representation with a strong retail presence augmented by a direct-to-consumer business; this is also a key to success in today’s evolving, dynamic marketplace. Probiotics have been a dynamic category, with over 15% compounded annual growth over the last ten years, according to NBJ. Being in great category can be a function of luck and timing, but sticking to a winning, long-term formula doesn’t prevent companies from adapting to changing trends and an evolving consumer audience. Doing so in an authentic and specialized manner makes for a roadmap to building enterprise value in the nutraceuticals space.

3. Pursue an Omni-Channel Distribution Strategy

This backdrop for solid, long-term growth has supported both small and large manufacturers and distributors of nutraceuticals. We expect this to continue, but exposure to certain channels is preferred, and multi-channel penetration may quickly become mandatory. Sales in nutraceuticals skew older, but the logical strategic focus for additional future growth relies on younger consumers. This sets up a situation where brands stand to benefit greatly by having meaningful or even outsized exposure to channels where younger consumers make purchasing decisions.

Online sales of nutraceuticals has grown to approximately 16% of the market in 2016 from below 10% in the mid-2000s, according to Nutraceuticals World. Green Circle believes the share gains have been net accretive to overall sales, which is to say that the online channel is bringing in and stimulating new buyers and new sales that would not necessarily have happened in other channels. This is distinct from a share grab from brick-and-mortar retailers that might have otherwise been neutral to industry revenue growth overall. While some sales have, in fact, migrated from brick-and-mortar retail to the online channel, overall, online sales have been far more additive than cannibalizing of sales generated through traditional retailers.

As today’s 30- and 40-somethings become 50- and 60-somethings in the next twenty years, we believe online will become the dominant channel for nutraceuticals. Today’s internet-savvy adults will become internet-savvy seniors. Not only that, but the internet channel has the ability to communicate more information and provide more SKUs in the same location, thus supporting the diversified needs of nutraceutical users and brands that sometimes purvey hundreds of items. It also lends itself to products that require communication with, and education of, consumers; therefore, it is an ideal fit for the industry. Emerging and progressive brands seem to agree. “Whether you’re selling to consumers directly or through online channels, communicating what your product is and how it works, and gathering feedback—both supportive and critical— is an essential part of a nutraceutical company’s marketing today. Doing that better is a big part of our marketing plan going forward,” said Claude Tellis, CEO of Naturade, makers of Vegan Smart and other products.

We anticipate online channel adoption for these products to contribute to gains in overall consumer spending, accelerated by existing trends and enhanced buying experiences. The online marketplace will evolve and improve the purchasing experience, including more feedback and education like that provided to consumers currently in some drugstores and natural products retailers. Currently, store personnel, who are sometimes pharmacists, provide much of the consultation and education that is truly needed to sell some of these products. We envision a future where online consultation will routinely be offered to engage consumers following an ad or story piece. This contact could be in the form of chat, video chat, or other as-yet-unknown communication platforms and may prove to be extremely beneficial to the industry, given its naturally high SKU levels online, need for certain product attribute education, and the risks associated with using incorrectly applied products.

Therefore, one way to enhance the value of any marketer of nutraceuticals is to work toward this technology-integrated future. Our investor colleagues tell us they value science and technology ahead of sales in some cases. Working to solve the gap between the existing online channel and the information and support provided by staff in the natural products store or pharmacy can add significant franchise value.

III. M&A Activity Recap

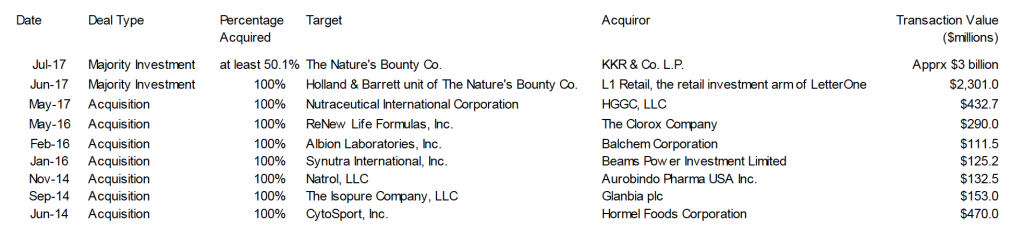

Merger and acquisition activity has been solid in the VMS/nutraceutical space in the last twelve months, with twenty-one announced deals through mid-October versus twenty-seven in 2016 and nineteen in 2015. The size of the deals has also been notable, with several large transactions led by the sale of Nature’s Bounty by Carlyle Group to KKR (50.1% for approximately $3 billion) and the acquisition of Nutraceutical International Corporation by HGGC, a private equity firm based in northern California, for approximately $433 million. Furthermore, it appears that activity from larger players will continue. Pfizer has announced that it is seeking strategic alternatives for its consumer business, which includes Centrum multivitamins and other products.

Green Circle focuses on the lower-middle markets. Here, too, we see signs of continued strength in the M&A and capital raising markets. The strength is driven by global factors such as central bank-driven liquidity, a generally positive global economy, and a persistent search for growth by both private equity groups and larger strategic participants. This provides a solid backdrop for M&A activity, and we believe these trends will continue, at least in the foreseeable future.

More specifically for our market tier, certain investors who were not formerly interested in the space have become interested as multiples in adjacent categories like food and beverage have grown to higher levels. Indeed, the recently announced sales of Ganeden and NeoCell could be closer to the beginning than the end of the current M&A cycle in the lower-middle market tranche of the VMS/nutraceutical space.

Transactions over $100 million since 2014

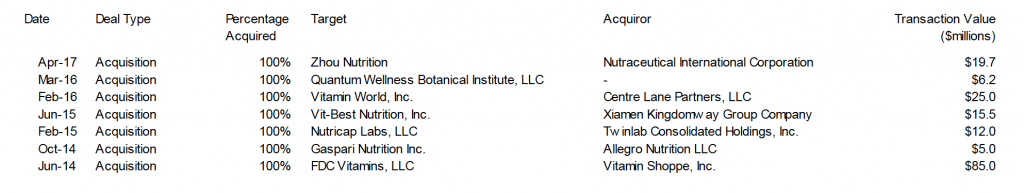

Transactions over between $5 million and $100 million since 2014

For further information, please contact the authors:

| Bakley Smith, CFA Vice President Green Circle Capital Partners [email protected] Office: 646-875-4870 Cell: 917-757-9350 | Stu Strumwasser Managing Director Green Circle Capital Partners [email protected] Office: 646-875-4870 Cell: 917-975-7994 |

Jeet Ganatra, Analyst, Green Circle Capital Partners

© 2017, Green Circle Capital Partners LLC

Securities transactions conducted through Dalmore Group, LLC, Member FINRA/ SIPC, New York, NY. Certain members of Green Circle Capital Partners are Registered Representatives of the broker dealer Dalmore Group, LLC.

This document is the property of Green Circle Capital Partners and for information only. It is not an offering for sale of any securities. This document may not be disclosed, distributed, or reproduced without the express, written permission of Green Circle Capital Partners LLC, New York, NY.